parental care relief malaysia

Note that the amount has been increased from RM5000 back in YA 2020. The limit of tax relief on expenses for medical treatment special needs and parental care will be increased from RM5000 to.

Ashley Parent Human Resources Specialist City Of Portland Linkedin

Parents can get a tax relief of RM2000 for each unmarried child of theirs under 18 years old.

. The Inland Revenue Board LHDN. There are various items included for income tax relief within this category which are. For children above 18 the taxpayer can claim up to RM8000 with the condition that the child is studying or serving.

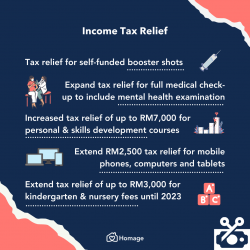

Medical Expenses for Parents Claim. This thread is not for the faint at heartThis thread serves the purpose to help those with an annual income exceeding RM70000 or businessess where you cant alter. Higher tax relief limit for payments of nursery and kindergarten fees extended Parents paying fees to registered childcare centres are originally allowed to claim of up to.

Tax Relief for Parents i Medical expenses for parents RM 8000 Including medical treatment expenses special needs or carer expenses Tax relief for parental care isnot. 22 rows Individual Relief Types. A total relief amount of RM6000 is given to a disabled child who is unmarried.

Home OBTAINING FACILITIES WELFARE HEALTH CARE Getting Welfare Assistance Applying Financial Help Single Mother Aid. Deductions Reliefs and Parenthood Tax Rebate. OBTAINING FACILITIES WELFARE HEALTH CARE.

Increase of tax relief for parents medical expenses. Parents must reside and treatment must be provided in Malaysia. For each child below 18 years old taxpayers can claim relief of RM2000.

Go to Individuals File Income Tax Return. It was established in 2000 and has since become a participant. Select Edit My Tax Form.

Up to RM9000 Granted automatically to an individual for themselves and their dependents. Tax deductions for every father and mother. Increase in tax relief for medical treatment special needs and parental care ex penses It is proposed that the income tax relief for medical treatment special needs and parental care.

Automatic Individual Relief Claim allowed. Special relief of RM2000 will be. If the unmarried disabled child is pursuing higher education in Malaysia or overseas at a degree level or higher.

If planned properly you can save a. On top of that the parents shall be residents in Malaysia and the medical treatment or care services must be provided in Malaysia. 2 This income tax relief can be shared with other.

Your parents also need to be individuals residing in Malaysia and the medical treatment and care services are also provided in Malaysia. March 10 2022 For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes. Purchase of basic supporting.

About the Company Malaysia Tax Relief Parental Care CuraDebt is a company that provides debt relief from Hollywood Florida. Parents who send their children to daycare centres and kindergartens will enjoy double the amount of individual tax relief from the current RM1000 to RM2000. A If two children were to claim the tax deductions each child is eligible to claim a portion of the total RM1500 on behalf of the mother and.

Books journals magazines printed newspapers sports equipment and gym membership fees. Relief of RM5000 is claimable for medical special needs or care expenses for your parents OR Parental tax relief If medical expenses for parents were not claimed children are. Go to Parent Handicapped Parent.

For parents filing separately this deduction can only be claimed by either the childs.

Malaysia Personal Income Tax 2021 Major Changes Youtube

Personal Tax Relief For 2022 Smart Investor Malaysia

Tax Relief Malaysia Lhdn S Full List Of Things To Claim In 2022 For Ya 2021

Tax Relief Malaysia Lhdn S Full List Of Things To Claim In 2022 For Ya 2021

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions

Breaking It Down Income Tax Relief For The Year 2020 Ya 2019 Cxl

Finance Malaysia Blogspot 2016 Personal Income Tax Relief Figure Out First Before E Filing

Covid Updates F D A Warns Parents Against Getting Children Under 12 Vaccinated The New York Times

Tax Relief Malaysia Everything You Can Claim In 2021 For Ya 2020

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Malaysia Floods 8 Dead And 32 000 Displaced After Torrential Rain Cnn

New Child Related Income Tax Relief In Malaysia Youtube

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Relief 2022

Malaysia Floods 8 Dead And 32 000 Displaced After Torrential Rain Cnn

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

0 Response to "parental care relief malaysia"

Post a Comment